Life Insurance in and around Terre Haute

Coverage for your loved ones' sake

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

Be There For Your Loved Ones

You might think you don’t need to worry about life insurance while you are young. Actually, it’s the opposite! It’s much better to secure your life insurance in your 20s and 30s. That’s why your Terre Haute, IN, friends and neighbors both young and old already have State Farm life insurance!

Coverage for your loved ones' sake

Don't delay your search for Life insurance

Why Terre Haute Chooses State Farm

Life can be just as unpredictable when you're young as when you get older. That's why now could be a good time to get Life insurance and why State Farm offers a couple of different coverage options. Whether you're looking for level or flexible payments with coverage to last a lifetime or coverage for a specific number of years, State Farm can help you choose the right policy for you.

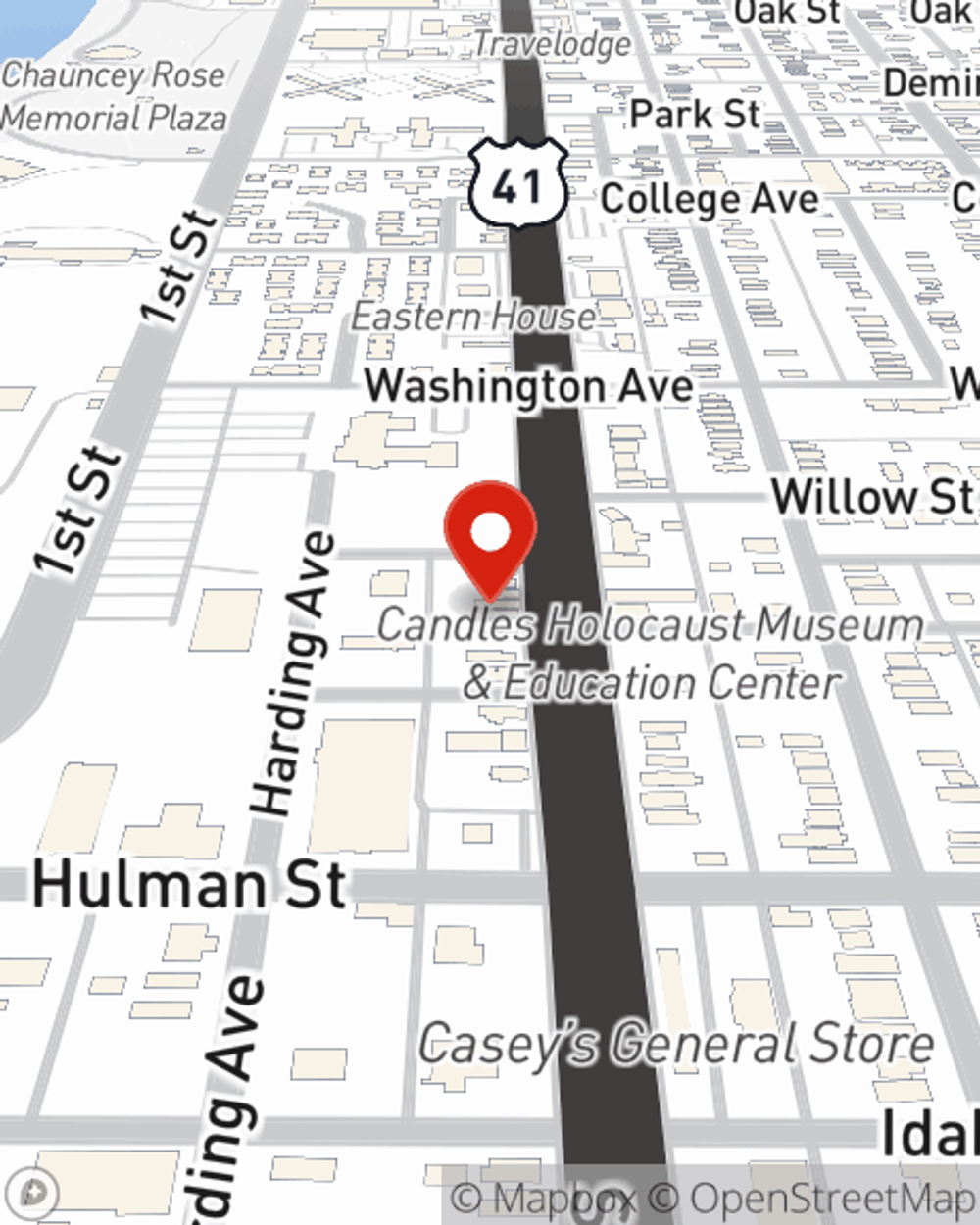

As a dependable provider of life insurance in Terre Haute, IN, State Farm is ready to protect those you love most. Call State Farm agent JD Pizzola today for help with all your life insurance needs.

Have More Questions About Life Insurance?

Call JD at (812) 299-1800 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.